Life Insurance in and around Thousand Oaks

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

When you're young and your life ahead of you, you may think Life insurance isn't necessary when you're still young. But it's a perfect time to start talking about Life insurance to prepare for the unexpected.

Protection for those you care about

Life happens. Don't wait.

Their Future Is Safe With State Farm

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the cost associated with providing for children, life insurance is a critical need for young families. Even for parents who stay home, the costs of finding other ways to cover before and after school care or daycare can be significant. For those who don't have children, you may have a partner who is unable to work or be financially responsible to business partners.

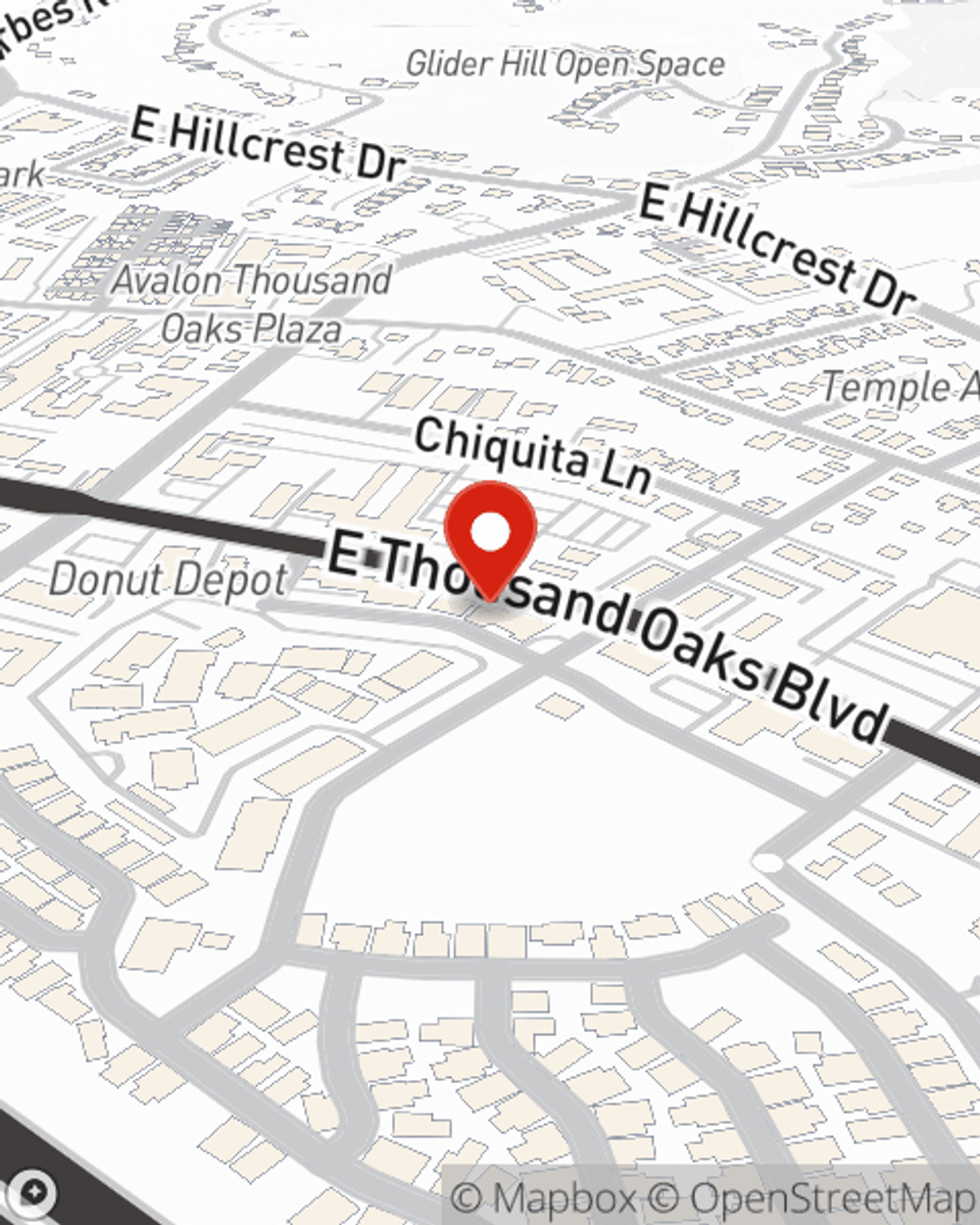

As a leading provider of life insurance in Thousand Oaks, CA, State Farm is committed to protect those you love most. Call State Farm agent Rick Hore today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Rick at (805) 379-0100 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.